Preparing for a CEO portfolio interview with a private equity firm

Darwin, a CEO, is currently working with a medium-size private company and is preparing for a CEO opportunity with a small technology-focused private equity firm focusing exclusively on a specific geography in the southeast United States. See how we’re preparing him for his upcoming CEO interview.

“My current role initially looked and sounded great on paper, and I thought I was walking into a growth situation with the ultimate goal being the sale of the company to a private equity or strategic buyer. Very quickly I realized it was a turnaround situation. The company was deeply in debt and in the 32 months since I joined, I’ve not had a bonus or salary increase."

No time to source a new opportunity

"Compounding the issue is that I now have no time to source a new opportunity and despite our solid performance over 32 months, the board is not willing to invest in resources to improve operations, which is sorely required. Without the capital investment, we will not be able to continue our trajectory and impact the valuation of the business.

This is not what I had in mind for my career when I joined this firm. My next position must be with a company that is well capitalized and or have owners who are willing to invest in the business. With a child in high school and college, I’m worried about our financial future.”

This is a recent scenario (details are fictionalized to protect the identify of the client), but the main points are true. We refer to this scenario as the bait-and-switch strategy. The CEO worked with an excellent recruiter, however, not long after joining the firm he realized his mistake.

Private equity job interview

Shortly after I spoke to this CEO, he was invited for a job interview for a CEO role for a private equity company in the US Southeast. He had never looked or applied for a job before. In his late forties, he’s now in a position to interview for a role, when previously he had been recruited. Back then job interviews were merely a rubber stamp process.

He also had never worked for a private equity firm. His approach to preparing for this interview will be different from preparing for a publicly traded corporation interview.

How private equity firms generally differ from public corporations

There are many differences. For the purpose of this discussion, I am focusing on the generalities of private equity companies for the sake of job interview preparation. There are obviously many differences, including business structure, capitalization and much more.

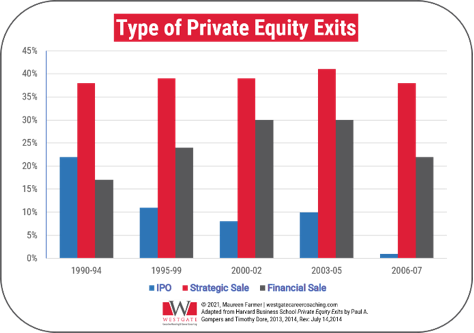

CEOs for private equity portfolio companies face a different challenge than most public and private CEOs because they are expected to produce results rapidly; they will face an eventual disposition (see the graph above).

While public company CEOs may have a longer runway in terms of producing tangible results, CEOs of portfolio companies owned by private equity firms will be expected to produce numbers (hopefully positive ones) within 9 months, according to Jeffrey Cohn and J.P. Flaum.

Source: “How to Avoid Mistakes When Selecting the CEO: Lessons from Titans of Private Equity"

What CEOs must do first

Our career advisory services focus heavily on preparation. The private equity recruiter will most certainly conduct intense and detailed due diligence on your candidacy, and you must do the same (see due diligence for CEOs blog) on the private equity firm.

Darwin and I discussed this at length – what could he have done differently to avoid a poorly performing company? The answer is simple: research and ask lots of questions.

Research is critical to prepare for your meeting.

You must understand the:

- Performance profile for the CEO (job description)

- Exit timeline (see graph above)

- Motivations of the firm’s decision-makers

- Industry and its trends

- Firm’s other portfolio holdings

- Board of directors

- Operating team

- Regulatory requirements

- Products and services

- Customer profile

- Portfolio company’s competitors

- Marketplace

- Brand of the private equity firm and its portfolio company

- Firm’s performance

Know the business model of the private equity organization. Private equity companies invest in undervalued but high potential businesses with the expectation they will realize an attractive ROI (return on investment) within a period of time. Your job will be to either grow the company or turn it around.

Private equity companies exit (dispose of their portfolio companies) under the following scenarios:

- Initial Public Offering (IPO) – the firm sells itself to the public on a stock exchange, such as the Toronto Stock Exchange, New York Stock Exchange, or others. There are currently 60 stock exchanges worldwide representing approximately $70.75 Trillion USD.

- Strategic Sale – to another firm in the same business.

- Financial Sale – the sale of the firm to another private equity or financial institution.

- Others: Leveraged buy-outs (LBO) and bankruptcy.

Source: Timothy Dore, Paul A. Gompers, Private Equity Exits, Harvard Business School, July 14, 2014.

The timeline for private equity portfolio holdings to exit has varied over the years and this perspective is interesting to note because CEOs of these firms will face their own “exit” once the organization has met its goals. Preparing for your own exit from the beginning will help mitigate the daunting challenge of looking for your next opportunity when the company sells (CEO Exit Strategy).

The board’s concerns

You will face dozens of questions throughout your candidacy, and you will need to be prepared to answer each question to the satisfaction of the board. Hiring CEOs is a risky business and firms will do whatever they can to mitigate the chances of a bad hire.

According to Toronto-based Marty Britton, CEO of Britton Management Profiles (serving clients since 1974), 72% of job candidates lie on their CVs. The biggest culprits are feigned job titles, false credentials, and inaccurate dates of employment, all of which will be carefully vetted during your recruitment and selection process.

It’s also critical you understand their point of view as you navigate the interview and selection process. The board will have a very different point of view than you during the meeting.

CEO job interviews—two perspectives

The CEO’s concerns during the job interview are very different from the board’s

- Will I align with the board?

- What is the salary?

- Will I get to choose my own team?

- How big is the office?

- Will I have an expense account?

- What are the benefits?

- Will I like it here?

- Is there a future in this firm?

- Why is the turnover high?

- Will they pay for my MBA?

The board’s concerns during the interview

- Are you competent?

- What will your onboarding cost us?

- Will you get along with your direct reports?

- How broad and deep is your professional network?

- How long will you stay?

- Do you really want to work here?

- Why did you really leave your last position?

- Will you make our board and investors look good?

- Will you steal from us? (yes, happens often!)

- What are you not telling us?

Protect yourself

You must consider the motivations of the firm and protect yourself. Here are a handful of considerations to ponder as you consider your own decision-making for this interview.

- Specifically, how will your performance be measured? When?

- Will you inherit a team?

- What is the scope of your decision-making?

- What is the management style of the operating team?

- Who will you directly report to?

- What type of access will you get to the partner?

- What is the structure of your compensation plan?

- What is the succession plan for the firm?

- Are there any outstanding legal claims against the firm or its holdings?

- What are they not telling you?

You will need to choose the most appropriate time and opportunity to raise some of these questions, preferably after you’ve received a job offer. Always have your new contract reviewed by an employment attorney, even if you’re a contract virtuoso.

The average time period for private equity portfolio company ownership is 5 years before IPO, strategic sale, financial sale or other type of exit. As the CEO candidate for this role, your keen preparation for this opportunity is your best strategy.

Preparing for your various meetings with the partners can be daunting, but we have produced some excellent tools for your preparation, including our popular 90-day plan.

Westgate offers full-service career advisory services that takes the guesswork out of job and board searches. Contact us today at maddison@westgatecareercoaching.com.