Firms do not hire people to fill CEO roles. Firms hire specific solutions to specific problems.

Both aspiring CEOs and experienced CEOs seeking an industry change and who are interested in venture capital and private equity firms will benefit from knowing the performance profiles for VC and PE CEO roles. A crystal-clear understanding of the financials, especially cash flow and the balance sheet, are key financial tools for the aspiring CEO and for the CEO targeting private equity portfolio companies.

This article focuses primarily on private equity firms and their portfolio companies. Venture capital companies are also briefly covered.

Private Equity Firm (Fund) Board of Director Composition

Private equity firms generally consist of institutional investors, such as pension funds, sovereign funds, endowments, and family offices. Additionally, they may also consist of accredited investors, wealthy private individuals, who are known as Limited Partners.

General Partners of the fund manage the investments of the Limited Partners for a management fee, called “carry.” Private equity investors acquire businesses for the fund with two or three primary goals. These firms will acquire businesses that meet their criteria, and the goal is to sell (exit) the acquired company within 3 to 5 years to a strategic buyer, financial buyer, and in some cases, the company will be sold through the initial public offering (IPO).

Private equity firms may meet with hundreds of companies over a year and only buy 2 or 3 that (depending on the size of the fund) fit their criteria. Often, once the sale is executed, the business may require the expertise of a new CEO.

The CEO performance profile for a private equity portfolio company is critical to the success of the transaction. Many private equity funds will maintain the current management team, but many funds will require new expertise, depending on the mandate (turnaround or market growth).

The private equity CEO will be required to produce results quickly, but never at the expense of the brand quality. In both growth and turnaround scenarios, CEO compensation will be based on stock options and the future equity of the portfolio company.

Private Equity Boards vs. Public Equity Boards of Directors

The role of the board is multi-faceted for boards of directors. One of the key roles of the board is to manage the performance of the CEO with a hands-off mandate to the daily operations of the organization because the daily responsibility of the CEO is to manage the business. Governance of the organization is critical to remain compliant with industry regulators and to mitigate risk for the organization.

Although governance is a key focal point for the board, Gadiesh and MacArthur (Memo to the CEO) refer to Nestlé’s success: “Like Nestlé, the best PE investors use boards not to manage the companies they own, but to reinforce the plans and help senior managers make the kinds of rapid and decisive moves that help foster success” (p. 22).

Private Equity Bosses

According to a seminal resource published by Bain & Co.’s Orit Gadiesh and Hugh MacArthur, called Memo to the CEO: Lessons from Private Equity Any Company Can Use, (Harvard Business Press, 2008):

“PE players are absolutely unbending in their insistence on performance. It’s not that they’re cold-blooded, or heartless, or inhumane. It’s just that their three-to-five-year time horizon doesn’t allow for very many misfires. They are systematic about thinking through what they need, what they’ve got, and where they need to fill the breach…They act quickly to replace senior managers who fail to deliver or who are judged inadequate to the challenge (p. 77).

The publication is older; however, the lessons are evergreen and can be applied to any company as the title suggests. In the book, the authors showcase the massive turnaround of Nestlé. It’s an excellent resource, and we would like to thank one of our former clients for suggesting it for this article.

A special note on PE portfolio company CEO compensation

As an aspiring CEO or CEO seeking an industry change in a PE portfolio company, it is important to understand your market value. Do your research and know your value proposition (your unique promise of value to the fund).

First, understand the compensation strategy of the industry (do they lead, lag, or meet the market). Know the cost of living in your region, because a CEO in Spokane, WA will have a higher cost of living than in Saddle River, NJ.

At Westgate, we help individuals determine their market value using sources, such as PayScale.com, Salary.com, specific industry association salary benchmarking surveys, and labor market data published by the US Bureau of Labor Statistics. Knowledge is powerful and having the knowledge will improve your leverage as you negotiate with the private equity organization.

In fact, the same source mentioned above (Memo to the CEO) stated the following for choosing CEOs for their portfolio companies:

“Look for people in lower-paying sectors who don’t yet know what they’re worth and would welcome the chance to sign on with a company (like yours) that’s clearly on the move. Give your hires extraordinary responsibilities and superb support, to increase the odds that they’ll win. And when they do win, treat them the way PE firms treat their winners: with extraordinary generosity.” (p. 86). This is my favorite passage in the book, because at Westgate we believe that when you work for an organization that honors your values and rewards your performance, everyone wins, including your family, investors, employees, and customers!

When you know what you do to help businesses make money, save money, and solve problems, you are then able to communicate your value position easily.

Know your market value. It will give you confidence during your search and throughout the negotiation with the private equity firm. You must understand your own performance profile.

If you're an aspiring PE portfolio company CEO

It is not necessary to have served as a PE portfolio company CEO to achieve the position. However, you will need to understand your value proposition very clearly. Do you understand the market? What is your track record? Have you managed (or mitigated) a crisis? Are you a candidate for a private equity CEO role?

To help give insight into what a PE portfolio can look like, let us examine TPG.

TPG is a global investment firm headquartered in the USA. It currently has $96B in assets under management.

Some of the companies in their vast portfolio include Airbnb, Burger King, Cirque Du Soleil, J. Crew, and Spotify.

Venture Capital (VC) Board of Director Composition & CEO Performance Profile

Venture capital boards of directors typically consist of the founder, co-founder, senior managers (who hold equity), angel investors, industry experts, and employees who hold equity (potentially).

The CEO of the VC company is typically the founder of the company, at least initially. Many times, the CEO is an investor and an entrepreneur and sometimes he or she is a serial investor. The primary role of the VC CEO is to attract new investors, manage the team, and get the company to break-even as soon as possible.

The National Venture Capital Association estimates that 25% to 30% of venture-backed businesses fail.

However, Shikhar Ghosh, a senior lecturer at Harvard Business School, stated that “about three-quarters of venture-backed firms in the U.S. don’t return investors’ capital.”

“If failure means liquidating all assets, with investors losing all their money, an estimated 30% to 40% of high potential U.S. start-ups fail. If failure is defined as failing to see the projected return on investment—say, a specific revenue growth rate or date to break even on cash flow—then more than 95% of start-ups fail”

Source: Deborah Gage. The Venture Capital Secret: 3 Out of 4 Start-Ups Fail. (The Wall Street Journal, 2012)

That said, in NVCAs’ most recent report (2021), they stated, “recent investment activity has been influenced by the Covid-19 pandemic and the permanent imprint it has left on everyday life. Many innovators and entrepreneurs are now focused on the abundant opportunities to develop technologies and build companies that address the needs of a reopening economy and a structurally different post-COVID environment.

Deal flow at all stages of the investment lifecycle appears healthy, but large and late-stage investments remain the main drivers behind overall strong deal value trends the industry continues to see. Late-stage VC investment through just the first half of the year ($108.8 billion) has almost reached the full-year 2020 total ($109.8 billion). Similarly, mega-rounds ($100 million+) in 2021 have already reached an annual record high of $85.5 billion.”

Source: PitchBook Data, Inc.Venture Monitor: Q2 2021 (NVCA, 2021).

While VC companies must remain compliant, make their payroll, and raise funds, their primary function is to get their product to the marketplace and get to the break-even point as soon as possible to satisfy investors and ensure their product is minimally viable. Of course, there are many famous examples of famous boot-strapping industry leading companies that began as VC’s and many have since become public companies and others sold to private equity firms.

CEO Accountability and Fiduciary Duty

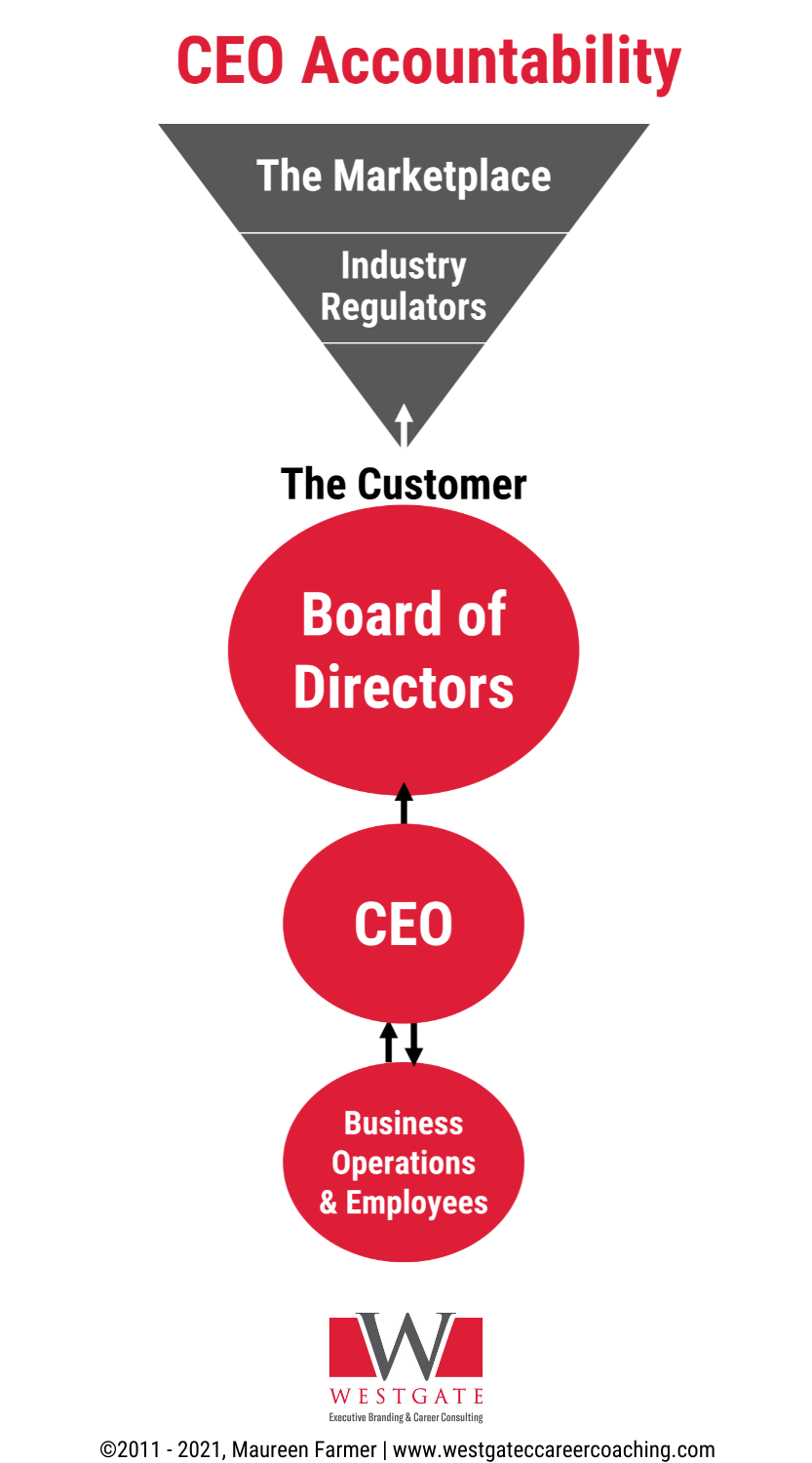

Regardless of whether you’re targeting a private equity portfolio company or are an investor yourself, it’s helpful to understand the accountability of the CEO.

The CEO has several stakeholders to whom she, he, or they are accountable, including the customer. Without the customer, there is no business, and without good people (that is in high performing employees) to help achieve the mandate of the organization, the 3-to-5-year mandate will not be achievable.

Again, to quote the famous Memo to the CEO, the role of the board of directors in the PE firm—in addition to governance and industry compliance, is to arm the portfolio company for success:

“If necessary, these PE firms also work with management down to one more level of specificity: which bodies in which seats? Which internal talents are a promising fit with this particular initiative? And what external talent can be brought to bear, including via outsourcing?

Make no mistake: PE firms for the most part don’t run companies. They don’t want to run them and will be the first to tell you that they wouldn’t do a very good job if they did run them. The best PE firms simply want to ensure that management is positioned for success. They are there, with internal or external resources, to help management deliver on its blueprint.”

As you consider your transition to a CEO role for the first time or are making a company or industry change, understanding where you fit in the value chain can add enormous value to your pitch.

A clear understanding of the CEO’s fiduciary duty is helpful when preparing for a job search, board appointment, or promotion. CEOs are accountable for the operations of the business. They are also accountable to the board of directors, investors, shareholders, industry regulators, and ultimately, the customer. Without the customer, there is no business.

However, what’s fascinating to me during job interviews (whether I’m coaching the CEO for an opportunity or vetting the CEO for the role), is the lack of focus on the customer during that conversation.

One of the unique services Westgate offers our clients is our CV Venture Capital and Private Equity distribution service. At $100k, 75% of jobs are hidden and at $300k, 90% of jobs are hidden. In recognizing this, Westgate dispatches your CV to a nationwide pool of recruiters and up to 8000 Venture Capital and Private Equity companies and decision-makers.

Contact us today to learn more.