Conduct your own due diligence when you’re targeting companies as part of your job or board search strategy.

Job offer due diligence & salary negotiations

Base pay is the single biggest concern when negotiating a job offer; however, there are dozens more important components of a good job offer.

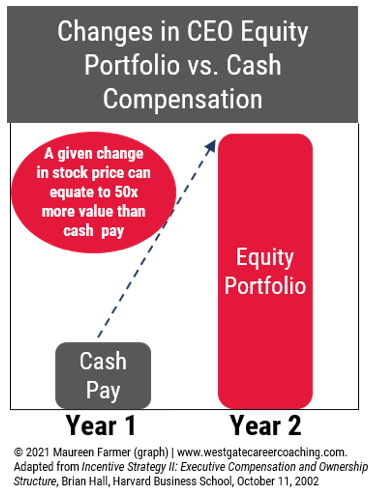

Base pay is also not always the most predictive indicator of financial growth when you consider the equity option. “And investors who can lose a lot of money for being wrong have strong incentives to scrutinize executive decisions closely”

Incentive Strategy II: Executive Compensation and Ownership Structure, Brian Hall, Harvard Business School, October 11, 2002.

“Typical year to year changes in stock price change the value of executive holdings by millions, or even tens of millions of dollars. Empirical evidence suggests that a given change in the stock price changes the value of equity holdings by approximately 50 times more than changes in cash pay.”

Negotiate your base salary with intention

- When negotiating your base salary, consider that the higher you negotiate within an established salary range, the higher your expected performance. Everyone will be watching, especially during the first 90 days. You must be confident at your ability to perform and provide evidence of your past performance (for example by using a 90-day plan).

- Understand the organization thoroughly, including stock price performance over time. Investigate the management team’s performance over time. While the board will be busy scrutinizing your résumé very carefully, you must also perform due diligence that could uncover important information that could impact your ability to perform well.

- Even if you’re vetting an offer from a private organization without equity, consider the total compensation program rather than only base salary.

- Private equity firms will expect your performance to be established and proven within the first 9 months. You must be clear on your value proposition – what you can do to help the organization make money, save money, or solve a problem.

Focus on the career opportunity itself and ignore compensation

According to Lou Adler, “In the final analysis, lack of money is not nearly the problem everyone thinks it is. Unfortunately, recruiters, managers, and candidates all use it as a screening tool. If an opportunity can accelerate your personal growth, great compensation increases will follow. For the right person, companies are willing to adjust their compensation ranges. Frequently jobs can be adjusted in scope and size to better suit the candidate’s requirements. However, none of this adjusting is possible if money is used as an early filter.”

The Essential Guide for Hiring & Getting Hired: A Performance-based Hiring Handbook, Lou Adler, 2013, Lou Adler (self published)

CASE STUDY

Bronwyn was the only parent of three young girls. Her elderly father also lived with them. As a blue-chip marketer, Bronwyn’s job was eliminated (post-merger) unexpectedly, catapulting her into joblessness. During her very generous severance process, she set out to re-tool her future. “I sometimes panic thinking I need a job now, versus obtaining the right job.” Finding a company that reflected her core values was critical.

Bronwyn kept her focus and only spoke with companies matching her criteria. Her financial future would be critical for supporting her family on her own. She carefully navigated the job offer, and with her excellent due diligence, she secured an exceptional package.

“I received, and ultimately accepted, an offer to be President of a global business unit. With your coaching, I negotiated enhancements to my package. I leveled up from VP to President and negotiated an 18% increase over my current base salary and negotiated a severance "umbrella" of 6 months’ pay upon any separation. Knowing my worth and not being afraid to ask for the elements critical to me were instrumental in landing this new role and compensation.”

Bronwyn | Global Commercial Marketing Executive | North Carolina, USA

Use evidence to support and substantiate your results

Clearly understanding your unique value proposition (UVP) is important for communicating value. The UVP answers the question “What will you do to make us money, save us money, or solve a problem for our organization?”

The answer is very important, obviously, because past behavior is a predictor for future success. However, in addition to your UVP, it will be important to explain to the decision-makers how you were able to produce results.

Here is a compelling UVP and excellent signature story:

“I produced a 36% year-over-year increase in EBITDA growth by leading a cultural transformation that propelled market expansion and growth in less than three years by putting the customer first and delivering value-added services that improved customer engagement for the long term. Our employees loved it.”

Having an inventory of rich signature stories like this can help the decision-makers understand how you work and provides an opportunity to expand on the story. Numbers don’t lie and if the metrics are verifiable and the quality of the work is corroborated by an external source (endorsements, financial reporting, audit reports, etc.), there is no denial of your ability to produce results.

Corporate due diligence and risk mitigation

The closer you get to an offer, the deeper they’ll look.

- A shocking 78% of candidates lie on their résumé, according to a top Canadian expert in pre-employment background checking in Toronto, CANADA (since 1974), Marty Britton of Britton Management Profiles, Inc. Boards will look carefully at your credentials from finger printing, reference checks, global sanctions checks, driver record searches, and much more.

- According to Marty, the top three sticky issues they encounter with candidates of every level in this order are: (1) Dates of employment (2) Falsified business titles and (3) Fabricated education degrees and licenses.

- Justus O’Brien of Russell Reynolds Associates (a global leadership advisory and search firm) corroborates the information above and recommends companies engage a third-party firm to do a full legal background check which can cost the firm up to $10,000 and is typically the final step before making an offer.

- According to (source), less-than-stellar activities that include parking violations, speeding tickets and SEC investigations are not necessarily deal breakers, but they can be indicators and predictors of risky behavior. However, the CEO candidate will likely have the opportunity to explain the events to the satisfaction of the board.

- The board, the recruiter, and other stakeholders will want to know your key reason for your interest in the role, especially if you were not referred or headhunted. Your reasons for leaving are your own; however, you will need an answer to that question that will satisfy the curiosity (and due diligence) of decision-makers. Your candor will depend on the circumstances behind your exit strategy from your current role. Riffs are common in business and when changes at the CEO or board level lead to an unbearable work environment, you may have no choice but to leave. You will need to carefully navigate that conversation without compromising confidentiality (we have a script for this).

Beware of bait-and-switch

Time horizons & stock vesting periods

Mitigate potential hiring issues during your exit strategy well in advance of a job interview

In an article published by the Harvard Business Review “Why Boards Should Worry about Executives’ Off-the-Job Behavior,” CEO candidates should be prepared to be deeply scrutinized during the vetting process. There are a handful of key areas firms consider, including:

- Insider trading

- Fraudulent reporting

- Suspicious consumption

- Firm-wide reporting risk

- A propensity to take chances

- DUIs

- Restraining orders

- Wage garnishing

- Traffic violations

- A common question of references, according to Justis Obrien, is “Is there anything else that would cause concern?”

I believe mistakes happen and most people don’t set out to make them intentionally or act with malice intentionally. If there is an issue you need to address, this is one time not to procrastinate. There are many resources available in the marketplace to help with legal issues and criminal infractions that can be expunged (consult an attorney).

Since 9/11 organizations are extremely cautious about the integrity of their businesses. Mitigating that risk will be their key priority during their due diligence.

You can do the same.

Annual Reports and Public Disclosure Mechanisms

Publicly traded companies are required to disclose their financial results on a quarterly basis. Taking the time to devour these resources and study them will help to prepare you for your salary negotiations and uncover any landmines that exist.

We worked with a CTO, let’s call him Donald, several years ago who hired us to help with a rapid exit out of his current global private company. The board of directors hired a former public company CEO who had faced criminal charges relating to insider trading. Donald left almost immediately after the CEO was hired because he did not want to be associated with him. In fact, we have worked with many executives who were suddenly faced with an unwanted change at the CEO and or board level. Your personal brand can be negatively impacted through association.

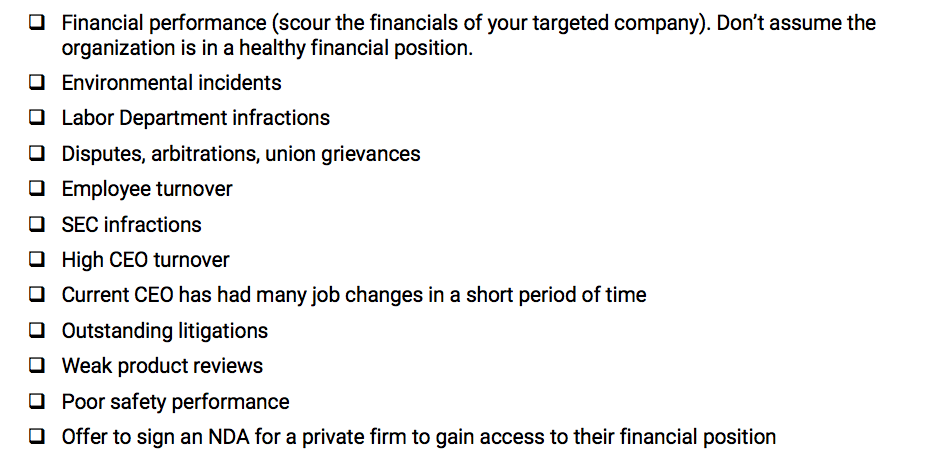

Here are a few indicators to look for:

First 90-Day CEO Feedback

Here is a small sample of feedback from our work with global executives. When we asked what surprised them the most in the first 90 days after joining the organization, this is what they said:

“Noticing how haphazardly the place was run.”

“A dysfunctional leadership team with a leader who only focused on metrics.”

“How unorganized the teams were, some who were not aligned and others whose skills were not being leveraged. This was a significant opportunity cost for the organization.”

“Illegal activities going on and the owner was unaware!”

“The silos among the departments.”

“That the organization had no focus on sales.”

“That I didn’t know who the actual owners of the company were.”

“There were no surprises!”

“Their compliance policies and procedures were grossly neglected.”

“The place was a mess. Revenues were dropping, with nearly no program delivery and the staff was in turmoil.”

Of course, not everyone’s experience is similar to this, but there are usually a handful of surprises candidates walk into. Your job is to reduce the number of surprises in the new role.

According to Marty Britton (see above), it costs up to 213% of the annual salary to replace a CEO. If the organization hires the wrong CEO for its firm, it can take up to 18 months to recruit, select, and onboard a new top chief. The opportunity cost is significant, not to mention the risk of loss of goodwill and reputation if they hire the wrong person.

However, what will it cost you if you choose the wrong organization?

See George's situation:

CASE STUDY

George moved from another province to assume a senior executive role in an energy company in the west. Highly qualified and deeply experienced, he was sought after by a national executive search firm.

George and his family, including his spouse and three children ages 12, 13 and 17 made the move several provinces west. Less than 16 months later, they returned east. The children were struggling in school and his wife could not find suitable employment in the new city. In an extensive exit interview, the executive disclosed his frustration and disappointment in the outcome of this major move. Not only did the company lose out on his expertise, the organization’s succession planning was thwarted and the personal toll to the executive and his family was extensive.

Conclusion

Trust but verify your job offer. Target organizations that are aligned with your values. I spoke to a client this morning who told me he will only target companies that have a profitable foundation. Knowing what you want is just as important as knowing what you don’t want.

Book a Confidential Conversation

Learn more about what Westgate can do for you.