This article is written for aspiring CEOs, private equity funds who have recently hired a new CEO for a portfolio company, and CHROs who serve the private equity sector.

First time CEOs

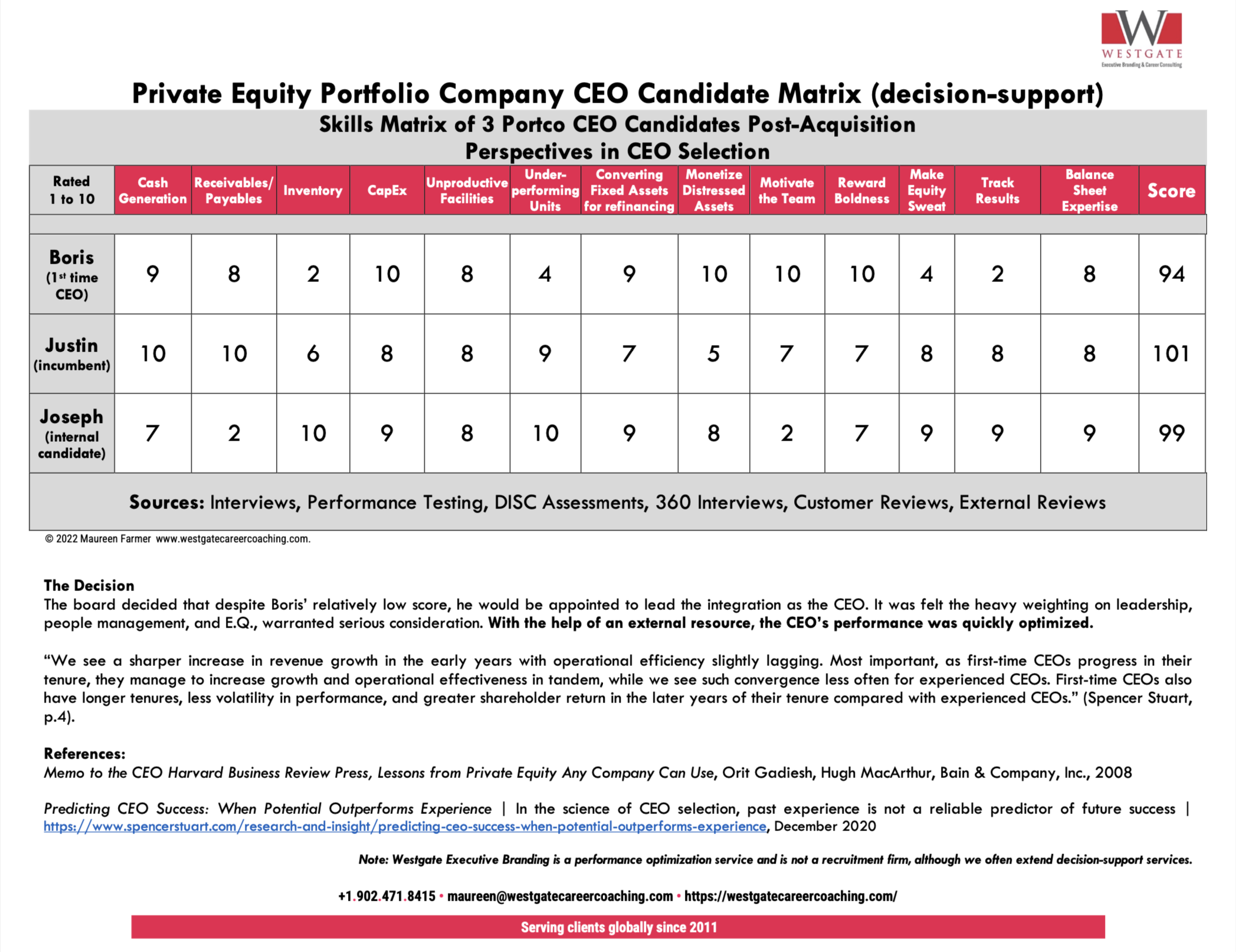

Selecting a CEO for your new portfolio company is often a challenge because there is so much at stake, and past performance is not always a predictor of future success for CEOs, despite it being the accepted principle in HR management for many decades.

While experienced CEOs bring a plethora of experience, there are many factors that dilute performance. Some leaders can become very comfortable with their work, to the point of not performing in the most dedicated way or offering valuable fresh perspectives.

In a SpencerStuart report, Predicting CEO Success: When Potential Outperforms Experience, it’s said, “for some, the prior experience becomes a seemingly logical proxy for future performance. As doubts seep in about an unproven candidate’s ability to succeed, the door closes on a far wider set of leaders with different demographics and backgrounds.”

However, the report continues… “Studying the performance of 855 S&P 500 chief executives over a 20-year period, a different picture emerges. We see higher market-adjusted total shareholder returns (TSR) for those serving in their first role. First-time CEOs on average lead three years longer and with less volatility in performance.

And when we look at a subset of CEOs who led S&P 500 companies in both their first CEO role and in subsequent CEO roles, 70% performed better the first time. The median year-over-year performance difference between a CEO’s first and second role was a staggering 7% per annum” (SpencerStuart: Predicting CEO Success: When Potential Outperforms Experience, 2020).

The Operating Partner (private equity fund)

The operating partner is an employee of the private equity fund and serves as an advisor to the portfolio of PortCo (portfolio companies) held by the fund. The CEO is the chief operating executive of the PortCo.

Ultimately the role of the operating partner is to help increase the value of the PortCo for an eventual exit (sale, merger, or IPO) of the business. The business may be a family business (multigenerational or otherwise) or another type of business that may be struggling to expand and scale or may require specialized services from the private equity fund.

The PortCo CEO (Private Equity Portfolio Company)

The CEO of the PortCo will serve as the chief operating officer for the operating company. The private equity fund supports PortCo as they continue to grow and expand. It is also for when the company requires improvements to cash flow, market expansion, and investments in assets required to deliver services to customers (new equipment, software, or other resources).

It may be that the CEO is newly recruited to the PortCo or the CEO remains serving as the CEO post-acquisition. There are many variations as well. A rising star in the PortCo may assume the lead role in the company. Regardless, there are many changes at the start of a new acquisition.

Operating Partner’s Primary Role

Operating partners often help with long-term strategic planning for the PortCo. and serve as the key communicator between the private equity firm and the PortCo. The Operating partner ensures the alignment of goals, and economics, and will assist with policies that may be new to the PortCo. Additional areas include:

- Setting the budget

- Identifying sales forecasts

- Sales supports

- Establishing levels of authority

Key performance indicators for the newly acquired PortCo

The best private equity operating partners and CEOs operate within the principles of transparency and honesty. The operating partner serves as a resource and support for the CEO and their team. Regular communication is encouraged, and the Operating Partner and CEO will often engage in weekly calls with the teams’ senior operators of the business to ensure alignment for things such as:

- On-time delivery

- Receivables

- Managing the best KPIs

- Ensuring a quality reputation of the operating asset

- Shorter-term objectives include cash availability

- They look for attractive growth-optimized industries

- Don’t like sudden market dips or climbs

- Seeking a differentiator (performance or process that is unique in the market)

- Unique connection to the customer base

- Being thoughtful on making major changes, especially in the beginning

- Can we fix short-term assets?

The relationship between the private equity fund and the Portco is a critically important one and must be managed very carefully for optimum performance for all.

Harnessing talent to drive performance

In the bellwether manifesto on private equity, Memo to The CEO: Lessons from Private Equity Any Company Can Use, by Orit Gadiesh and Hugh MacArthur (Bain & Company, Inc.), a key success factor for the fund is the ability of the fund to “harness talent” in their PortCos (Pg. 74).

What the experts say:

- Monitor what really matters

- Cash, not earnings

- Use metrics to stay ahead of financial results

- Use rewards to motivate and align—that is, pay employees for what you want them to do

Because private equity owners are so focused on performance, the CEO is the key leader who will deliver performance for the private equity fund.

The same source says, “…their (private equity) three-to-five-year time horizon doesn’t allow for very many misfires. They are systematic about thinking through what they need, what they’ve got, and where they need to fill the breach. This doesn’t leave much room for turning a blind eye to missed performance goals. Even though it is always hard to move people without disrupting the team, PE players bit the bullet. They act quickly to replace senior managers who fail to deliver or who are judged inadequate to the challenge (P. 76).

Challenges new PortoCo CEOs face:

- Establishing trusting relationships with the board of directors

- Committing to new financial models, budgets, and sales forecasts

- Managing complex relationships with external constituents, including the media, analysts, regulators, and suppliers

- Protecting the reputation of the company during difficult times

- Managing crises

- Navigating the isolation of the CEO role

- Learning new systems

The role of Westgate

New leaders often struggle, not because their financial or operational abilities are inadequate, but because their style or political skills render them unprepared to manage the new organization’s culture. Helping leaders understand that culture and improve their “soft skills” to successfully navigate it may be the best way to increase their chances of success.

We have designed a simple but powerful system to help CEOs optimize their performance to:

- Identify core values and establish goals for the first 90 days as the CEO.

- Uncover the personal brand, including personal marketing documents, and advanced networking strategies that open doors to decision-makers and influencers.

- Tap into centers of influence and design networking strategies. We take the guess work out of networking and authentic messaging.

- Test assumptions of how others perceive the CEO to ensure team-board alignment.

- Foster positive relationships with the board of directors, improve engagement with the senior leadership team, and uncover thought leadership strategies for external audiences. Regulators, customers, investors, employees, and other constituents need to feel confident in the CEO’s capabilities.

In the previously mentioned article by SpencerStuart, it is noted, that “the risk of stagnation increases if the CEO’s prior experience discourages the team from raising important dissenting views and unconventional ideas. To confront this risk, one CEO advised, ‘throw out the playbook filled with actions and instead bring one full of questions.’ Doing so empowers CEOs to adapt to their new business environment and devise a fresh playbook tailored to their unique challenges.

Westgate supports the new CEO in creating that playbook full of the right questions to unleash performance and support accountability with the fund.

For aspiring CEOs, C-levels, and business leaders

Learn about the Career Navigator Program (CNP) now in its eleventh year. Jump-start your C-level trajectory with a proven process and framework used by thousands. And, leverage the global labor market by uncovering a powerful brand that will speak on your behalf in front of organizations who don’t know about you. A powerful brand speaks for you when you’re not in the room while thriving during economic downturns because strong bands weather difficult times.

For CHROs, private equity funds, and boards of directors

Learn about the C-Suite Optimization Program (CSOP), which is designed to help your new CEO on board safely and effectively thereby protecting your investment in the new leader. By doing so, you will reinforce your business plans early and help the CEO make the kinds of rapid and decisive moves that help foster success in the long term.

Get in touch

If Westgate can serve as a resource to your board, we’d be happy to explore with you. Drawing on 25 years’ corporate experience and serving organizations in the United States and Canada, Westgate Executive Branding is a 100% independent firm with no affiliations with recruitment or outplacement firms. Schedule a confidential conversation with our Client Success Strategist, Maddison Shears at maddison@westgatecareercoaching.com.