Are you a Turnaround or Growth leader seeking a new opportunity?

The pathway to a CEO role for a portfolio company may be a logical next step in your career when you consider the structure of a private equity firm and its particular mandate and meet the performance criteria.

It’s a complicated industry, certainly, but some similarities across private equity funds provide helpful context to understand what they generally seek in a portfolio CEO.

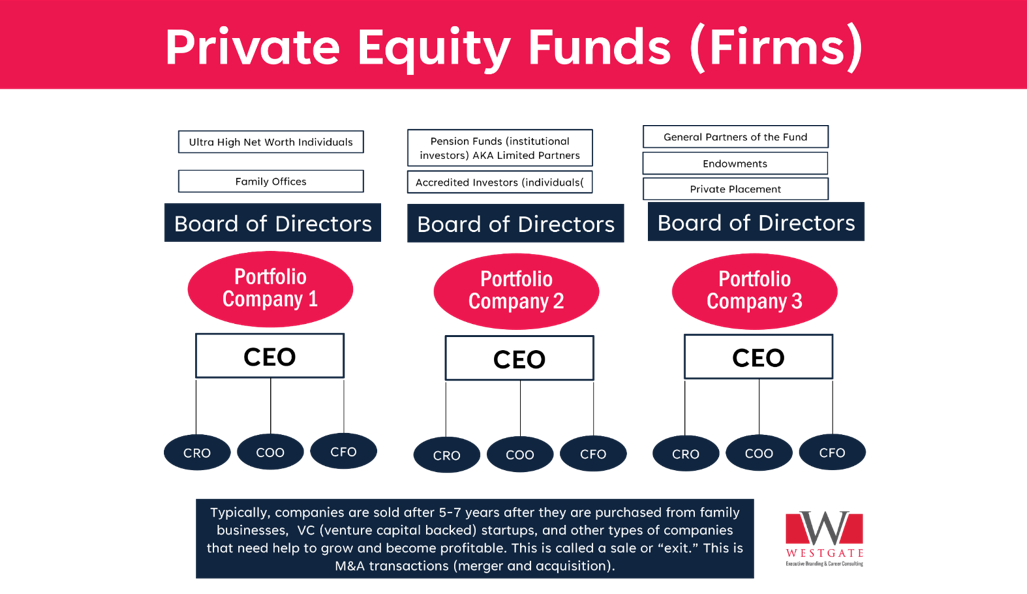

As a basic structure and construct, private equity firms generally invest in companies requiring help with financial and market growth. Many firms have an industry focus, and others diversify across sectors. I don’t believe you need to be a private equity expert to serve as a CEO in a private equity-backed company. Business is business, and companies need to remain liquid, serve their customers, and be profitable.

Considering a CEO search in this asset class, private equity firms purchase (invest in) portfolio companies for several reasons. Some are to help the company prepare for a strategic sale, for an IPO (initial public offering), or to help it scale to the next level.

Access to capital is a key reason firms seek the help of the PE firm, but that’s not all. Private equity firm leaders have lots of experience growing and supporting their portfolio companies and serve as advisors to those companies. Cross-portfolio collaboration also helps companies grow, scale, and manage risk.

Here is a generalized organization profile for a private equity firm.

PE Portfolio Performance Profile (communication/behavioral style):

Private equity firms are interested in investing in portfolio companies with strong management teams. General managers and divisional presidents with strong performance profiles will be attractive to those firms. Knowing and articulating your strengths in your executive marketing collateral will help you build credibility and authority.

Consider the performance profile of a high-performing leader taken from our inventory of profiles:

- You set high goals for yourself and others and expect to meet those goals. This trait comes from your high degree of decisiveness, sense of urgency, and risk-taking ability. This combination is somewhat rare, descriptive of someone with high expectations. If someone says it can't be done, your response may be, "Just watch me."

- You are an excellent problem solver who can think quickly on your feet to solve problems that arise. You can do this due to your rapid decisiveness, ability to multi-task, and your tendency to "blaze your own trail" rather than follow the beaten path.

- You tend to be more of a doer than a dreamer. Some people dream of making things happen, but you prefer to work hard to effect change. If something needs to be done, you'll roll up your sleeves and do it.

- You frequently look for new, better, and more efficient ways of getting things done. Abdallah, you score like those who have a multi-tasking mind. You tend to have high urgency and little aversion to risk, often seeking ways to reduce costs (both money and time) and make systems more streamlined and efficient.

- You are a strong individualist who likes to forge your own path and to be recognized for your achievements. Your responses to the instrument indicate that you are "field independent" in your operating style. That means that you blaze your own trails, sometimes without seeking much input from others. You may feel a greater sense of internal accomplishment when success is achieved mostly on your own, without much guidance or assistance.

- You show a wide variety of interests in many areas. This is of enormous benefit in both social and business life. Your wide range of curiosity allows you to keep a pulse on varying topics of widespread interest. As these topics converge and diverge, you may be positioned to benefit from this broad knowledge base.

- You have many ideas and opinions of your own and a high degree of confidence in those ideas. It might be said that people who score like you tend to have a rather visible ego presence. However, those who manage this can thrive in a more people-friendly work climate.

- You tend to rely more heavily on your own opinions than on the evaluations of others. This is a symptom of your independence and can potentially lead to some problems, especially where rules, details, or minutiae are concerned. This may result in cut corners or overlooked details. You may balance this by seeking input from those with more expertise in a particular area.

Our performance profile reports are scientifically validated and provide a key component of your value proposition to present to the recruiter and board of directors. Industry expertise aside, the motivation of the CEO candidate must be clearly articulated.

Use the performance profile report to create your CEO marketing collateral, including your resume, LinkedIn profile, and elevator pitch.

You must understand its mandate and focus to be attractive to a private equity firm. And you must differentiate yourself from the dozens of your competitors and peers.

Understanding business drivers and what actions matter to the PE firm will help formulate a CEO value proposition based on past performance. Performance is critical because of the relatively short mandate (3 to 5 years typically). PE firms don’t have the luxury of time to wait for performance, and “They (PE firms) act quickly to replace senior managers who fail to deliver or who are judged inadequate to the challenge.” P. 76 Lessons from Private Equity Any Company Can Use, Bain & Company Inc., 2005.

CEO candidates with established work plan practices and financial tracking, including business forecasting, sales forecasting, and product forecasting, and having an excellent understanding of historical financials and benchmarks will be very attractive to the firm. CEOs with strong sales management practices (such as peer-to-peer sales presentation reviews) with strong planning skills are valued.

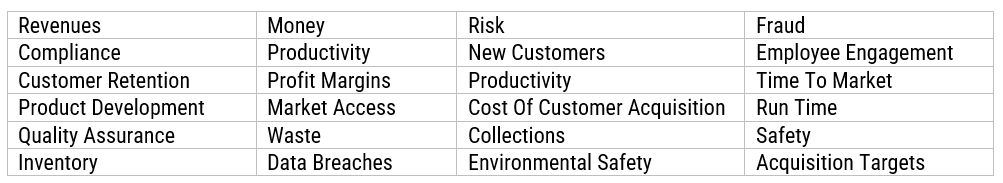

The following charts are business drivers and actions that PE firms consider important as it relates to managing working capital and delivering value, which is closely monitored by the board.

Business Drivers (problems you solve for them):

Determine the solution(s) you offer to an employer. Understand what employers care about.

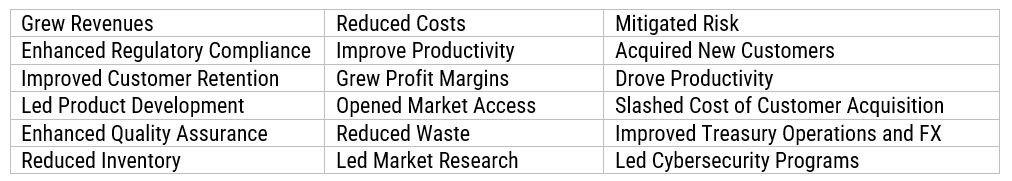

Actions Taken:

The key components of the CEO candidate's marketing portfolio are articulating the value proposition using the key metrics that PE firms value complemented by the performance profile. In today’s terminology, it’s the hard skills + soft skills that match the CEO mandate.

To explore our personal branding and career strategy solutions, visit us at www.westgatebranding.com.