Next level, next devil & your rise to the C-suite (with a CEO matrix)

And how business titles can make your negotiations easier.

There are many stakeholders vested in your appointment to the CXO level.

In the early stages of your consideration for the CEO role, your CV will be socialized among the stakeholders and while 100% agreement may not be required to seal your offer, there will be many perspectives you will need to address during the selection process.

From a functional point of view, the new CEO must work with their new team—all who have their own agendas. The CFO, CLO, CMO, CTO, CCO, CRO must also agree on the new leader’s appointment. Additionally, the recruiter, the board of directors, key shareholders, and other stakeholders will all be consulted. The closer you get, the harder they’ll look.

Your motivation for wanting to make the transition to the leadership team will be closely scrutinized.

Your value proposition & your motivation

When your motivation for up-leveling matches your value proposition, you’re on the path to an offer. The clarity of your focus will bring comfort to you and the selection team. If, on the other hand, you’re unsure about your motivation, maybe it’s time to pause and reflect.

While your leadership credentials and business acumen are key to securing an offer, as equally important are your reasons for wanting the role. There seems to be a perception that the CEO role is glamorous and pays well with lots of perks. While this may be true, it may not be the best motivation for wanting to lead the team.

You must have a believable and achievable value proposition and it must be backed with evidence you can do the job and that you want to do the job.

According to a Harvard Business Review article, by Dan Ciampa, After the Handshake – Succession Doesn’t End when a New CEO is Hired, “ … one-third to one-half of new chief executives fail within their first 18 months, according to some estimates. Some of these flameouts can be attributed to poor strategic choices by the new leader, and some result when the board makes an imperfect choice—overestimating a candidate’s abilities and potential or hiring a leader whose skill set doesn’t fit the context.”

You, yourself, as the CEO candidate also own the responsibility to ensure the organization is the best fit for you and your family. Candidates typically spend more time choosing their Caribbean holiday than they invest in their own due diligence on the organization they’re interviewing for a CEO role.

Ensure you understand the opportunity before you accept the offer.

Your qualifications for the CEO role

“What is qualified? What have I been qualified for in my life? I haven't been qualified to be a mayor. I'm not qualified to be a songwriter. I'm not qualified to be a TV producer. I'm not qualified to be a successful businessman. And so, I don't know what qualified means.” Sonny Bono, American singer-songwriter, producer, actor, and politician.

You likely believe you’re ready for the C-suite and this may be true. How do you know when you’re ready? Organizations use many tools to select their next leader and one of those tools is its succession plan. The firm needs to choose senior managers using a defensible process that produces the best outcomes for the organization, its investors, and its customers. Third-party recruiters, industrial psychologists, selection committees, and in-depth psychological and personality assessments are many of the tools required for this key task

As a CEO applicant, candidate, or careerist (a careerist is someone who’s a career planner), you can complete a self-assessment that will help you gauge your potential candidacy for the role.

Ideally there is a position description, performance profile, or job description available. Recruiters will often provide a selection package. You can easily begin here.

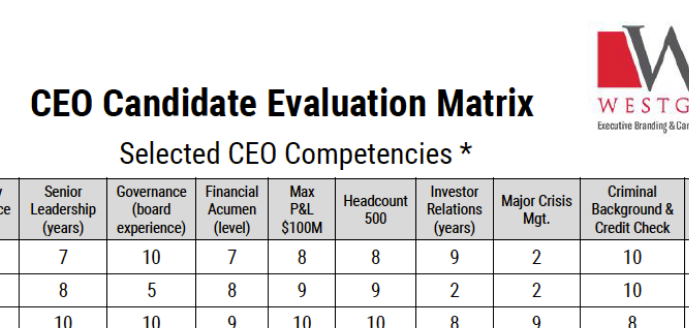

There seems to be a secret-society perception of CEO candidate evaluation. If it’s done correctly, your candidacy will be compared against the other candidates’ competencies in a logical and defensible process. A skills matrix works well for this type of objective process. At the end of the day, the selection committee must have a scored selection criteria for defending their decision to the board, investors, or shareholders.

Understand the job description in detail

The job description, position description, or performance profile become your north star as you prepare for your job interviews. All things being equal, it is how you will be compared with your candidate peers. The job description will become the basis for job interview questions.

Here is a partial list of competencies required for the CEO role for a private-equity-backed company, ZZZ Tips, which provides cloud-based software and consulting services for 50% of North American hospitals which enable centralization and compliant management of hospitals’ contracts with physicians and nurses. Their product, Purchase 4, provides spend benchmarking data and spend optimization services.

As a CEO candidate, your competencies will be compared against others in the selection pool. When you understand the exact requirements of the job and compare your skills with the requirements, you will know where the gaps are and then you can address them in your CV and upcoming job interviews.

Required CEO Competencies (from the job posting)

- Industry experience: With 10+ years in the industry, the CEO will have led at least one successful, auditable experience as the CEO of an independent company with revenues of at least $70 million and EBITDA of $18 million.

- Senior Leadership: At least 5 years experience and one demonatrated successful experience as the CEO of another company or the leader of a P&L for a major division or subsidiary on which they made a significant positive impact, including impeccable employee enagagement scores.

- Corporate Governance Experience: Direct reporting relationship to the board of directors and extensive experience with board reporting, finance and audit committee participation.

- Financial Acumen: Formal training as a CPA or CFA with at least 7 years experience leading M&A with financial analyis, reporting, and financial decision-making.

- Maximum P&L: Experience in having been employed by a successful, high quality company in excess of $500 million in revenues and $100 million in EBITDA

- Headcount: Experience leading at least 500 employees across multiple divisions and North America-based organizations.

- Investor Relations: At least 5 years experience leading pitches to investors and evaluating M&A proposals.

- Crisis Management: Direct experience managing crisis and mitigating risk, specifically with relation to COVID-19 challenges collaborating with the board of directors to mitigate interruptions to customer requirements.

- Criminal Background & Credit Check: A perfect credit score and satisfactory criminal background check are required.

A note on business titles and why they’re important

Whether you’re ultimately targeting a c-level role or are offering the title to one of your direct reports, understand the significance of business titles. They are business tools that help you and your team negotiate timely and important deals for your company. Access to the decision-maker in the opposing business can make a deal close faster—or slower. Lack of access to the decision-maker can kill it, and your business title can make the difference.

Albert’s story

Albert negotiated his appointment to the VP of Engineering role (using the hidden job market) to lead the implementation of a $5.9M building systems project for a new commercial building in a major North American city. It was a high-profile role for which he was both proud and excited to assume. An expert in energy management strategies and a keen understanding of mechanical systems for utilities, he was positioned to help the company save hundreds of thousands of dollars in efficiency improvements as part of the design of the new building.

Originally Albert was offered the title of Director of Engineering. Knowing the commercial real estate market and understanding the intricacies of mechanical and electrical systems commissioning—with a focus on energy efficiency—Albert was wise to negotiate the title of VP Engineering while reporting directly to the CEO of the company.

One of the key energy efficiency strategies was the negotiation of a unique contract that would avoid $100,000 year over year in energy costs. Albert signed his employment agreement and tendered his resignation. Excited to start the new role, he arrived on his first day anxious to begin.

Shortly after his onboarding, Albert was deeply disappointed to learn he would not be reporting directly to the CEO, but to the CFO. Reporting directly to the CEO would have tremendous advantage for Albert and the company because he would have a direct line of communication to the chief decision-maker of the organization.

Given the CFO had no engineering experience and did not understand the complexities of energy economics, Albert now had a barrier to quick decision-making, an important aspect of negotiating. He would now need to educate the CFO on the reasoning behind his recommendations and brokering agreement before getting the approval of the CEO.

The correct-level business title will signal your positioning and negotiating power to the marketplace. While many careerists seek job titles for the status it offers or the expected compensation, it is an otherwise key tool in business negotiations, although seldom considered in a job offer negotiation.

Takeaways

- Understand your motivations for seeking a C-level opportunity. You will be asked this question many times during the selection process. A certain answer will instil confidence in the board and other key decision-makers.

- Evaluate your competencies against the required skills listed in the job description or position profile. You will be scored against other candidates.

- Business titles can be used in job offer negotiations. They are key tools to help open doors to organizations and key decision-makers. The wrong title can add months to an otherwise straightforward negotiation.

- Know your value proposition: What will you do to make money, save money, and solve specific problems for the targeted organization?